The Definitive Guide for Stonewell Bookkeeping

Table of ContentsSome Ideas on Stonewell Bookkeeping You Should KnowThe Best Guide To Stonewell BookkeepingThe Best Strategy To Use For Stonewell BookkeepingThe smart Trick of Stonewell Bookkeeping That Nobody is Talking AboutThe Single Strategy To Use For Stonewell Bookkeeping

Here, we address the inquiry, how does accounting help a service? In a sense, audit books represent a photo in time, however just if they are upgraded often.

None of these final thoughts are made in a vacuum cleaner as accurate numeric information must strengthen the financial decisions of every tiny organization. Such information is assembled through bookkeeping.

Still, with correct capital administration, when your publications and journals depend on day and integrated, there are far fewer enigma over which to stress. You recognize the funds that are offered and where they fall short. The information is not constantly good, however a minimum of you recognize it.

Stonewell Bookkeeping Can Be Fun For Everyone

The maze of reductions, credit histories, exceptions, schedules, and, naturally, penalties, is enough to merely surrender to the internal revenue service, without a body of efficient documents to support your insurance claims. This is why a committed accountant is important to a small company and deserves his/her weight in gold.

Having this information in order and close at hand lets you submit your tax obligation return with convenience. To be certain, an organization can do whatever right and still be subject to an IRS audit, as many currently recognize.

Your service return makes insurance claims and representations and the audit targets at verifying them (https://stonewellbookkeepi.wixsite.com/hirestonewell/post/why-professional-bookkeeping-is-key-to-your-business-success). Great accounting is everything about linking the dots in between those depictions and truth (best home based franchise). When auditors can follow the info on a ledger to receipts, bank declarations, and pay stubs, to call a couple of documents, they promptly find out of the expertise and integrity of the service organization

The Only Guide for Stonewell Bookkeeping

In the very same means, slipshod bookkeeping includes to tension and anxiety, it likewise blinds local business owner's to the potential they can recognize in the future. Without the details to see where you are, you are hard-pressed to set a location. Just with reasonable, thorough, and factual information can an entrepreneur or administration group story a course for future success.

Business proprietors recognize finest whether an accountant, accountant, or both, is the appropriate option. Both make important contributions to a company, though they are not the exact same occupation. Whereas a bookkeeper you can try this out can collect and arrange the info needed to support tax obligation preparation, an accounting professional is better matched to prepare the return itself and truly evaluate the revenue declaration.

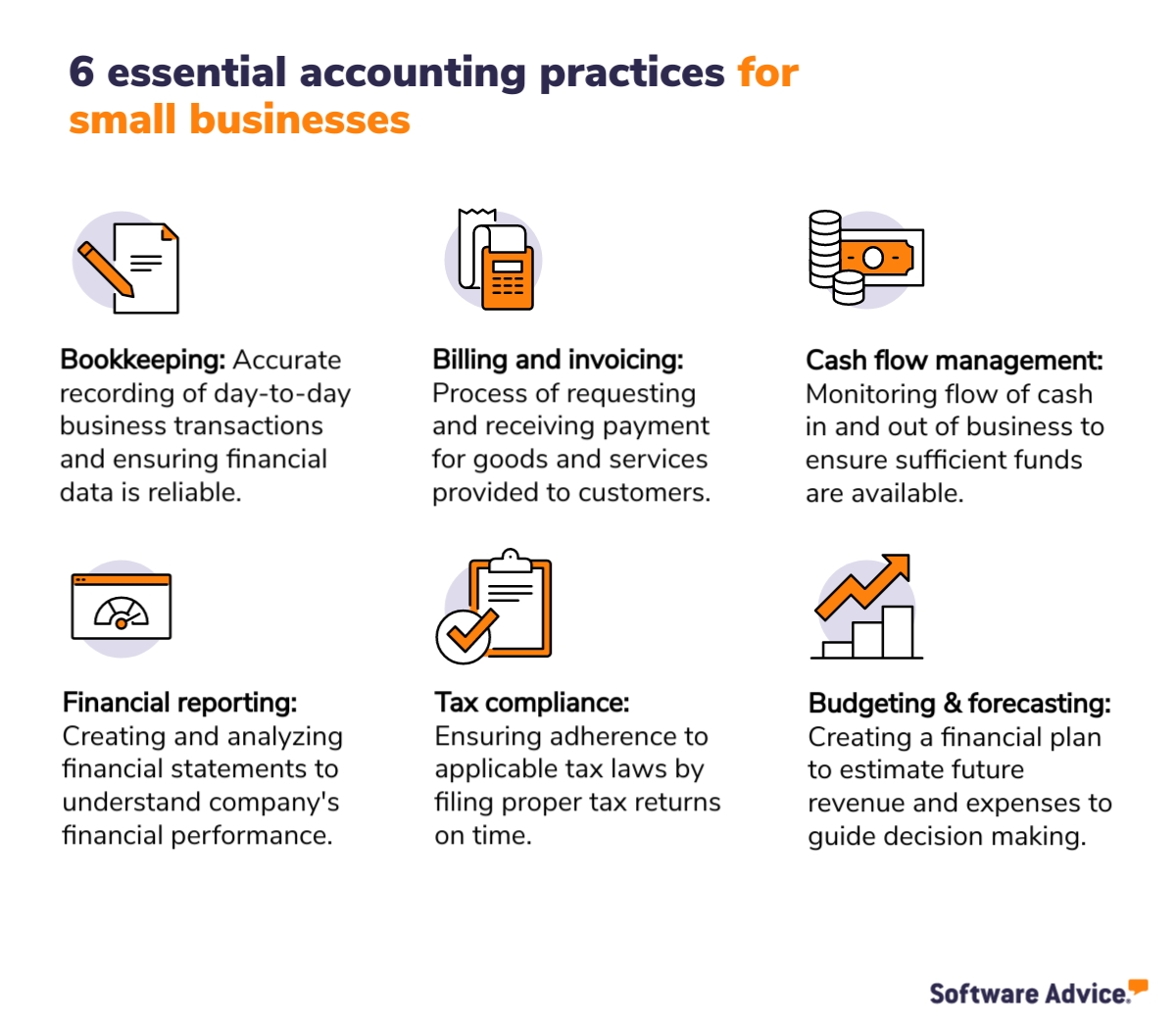

This short article will delve right into the, including the and just how it can benefit your service. Bookkeeping entails recording and arranging monetary transactions, including sales, purchases, payments, and invoices.

By routinely upgrading financial records, bookkeeping aids organizations. Having all the monetary information conveniently obtainable maintains the tax obligation authorities pleased and avoids any type of last-minute migraine throughout tax obligation filings. Routine bookkeeping makes certain well-kept and organized records - https://www.lidinterior.com/profile/stonewellbookkeeping7700262003/profile. This aids in quickly r and conserves organizations from the anxiety of searching for papers throughout deadlines (business tax filing services).

Things about Stonewell Bookkeeping

They likewise desire to recognize what capacity the business has. These facets can be easily handled with accounting.

By maintaining a close eye on economic records, companies can establish reasonable goals and track their progress. Normal accounting guarantees that services remain certified and stay clear of any type of charges or lawful problems.

Single-entry accounting is basic and functions finest for tiny companies with few transactions. It involves. This method can be compared to maintaining an easy checkbook. It does not track properties and obligations, making it less detailed contrasted to double-entry accounting. Double-entry accounting, on the other hand, is more innovative and is generally considered the.

.jpg?token=7cd2150746d7a6091d181e6f1b4de871)

The Facts About Stonewell Bookkeeping Revealed

This can be daily, weekly, or monthly, relying on your company's dimension and the quantity of transactions. Don't think twice to seek aid from an accounting professional or accountant if you locate handling your financial records testing. If you are trying to find a complimentary walkthrough with the Bookkeeping Option by KPI, call us today.